Asset Management

By ERPNext Administrator on October 16, 2024

BeginnerAn Asset is any valuable Item owned by a Company.

Furniture, computers, mobile phones, printers, cars, manufacturing equipment are examples of assets. Generally, an asset is a tangible item that is located on the company premises or is carried by an employee. In some cases, an asset could be an intangible item.

In ERPNext, the Asset record is the heart of asset management module. All the transactions related to an Asset like purchasing, depreciation, maintenance, movement, scrapping, sales will be recorded against the Asset record.

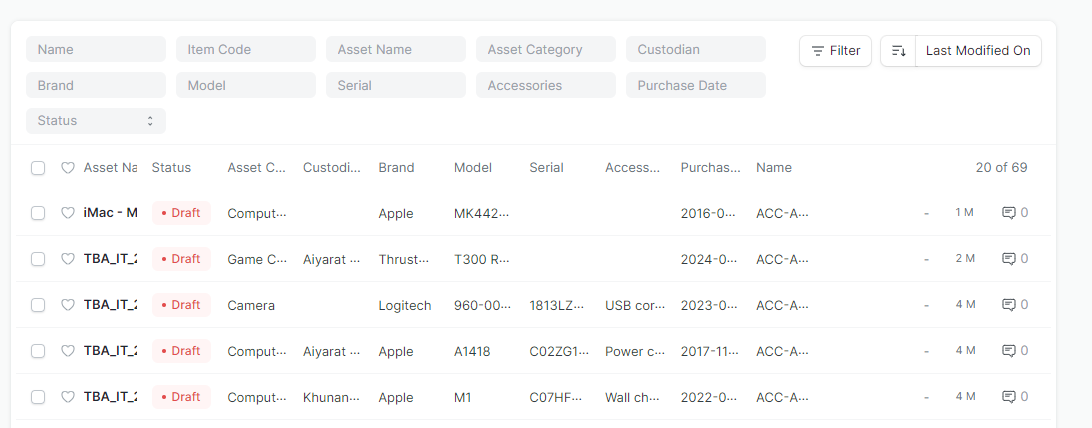

To access the Asset list, go to:

Home > Assets > Assets > Asset

Prerequisites :

How to create an Asset

- Go to the Assets list, click on

.

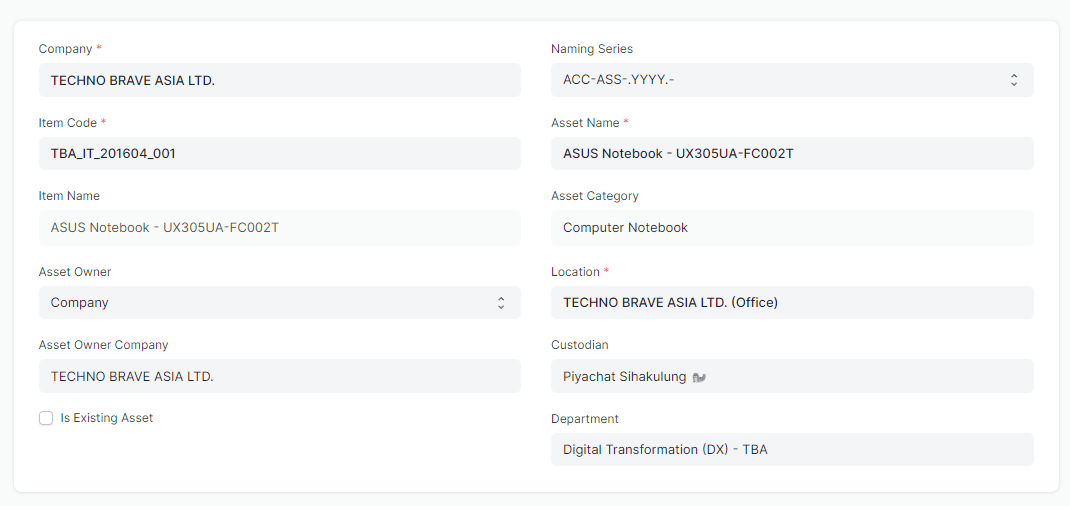

. - Select the Item Code. Item Name, Asset Category and Asset Description will be fetched automatically.

- Select the Asset Owner, i.e. Company, Supplier, or Customer.

- Select the Company/Supplier/Customer.

- Select the Purchase Receipt/Purchase Invoice. Purchase Date and Gross Purchase Amount will be fetched automatically.

- Select a Location. Eg: TECHNO BRAVE ASIA LTD. (Office)

- Select a Custodian (The employee who will carry the asset).

- Select the department of the Custodian.

- For an existing asset, you can create the asset record directly by checking "Is Existing Asset"

- Save and Submit.

Additional options when creating an Asset

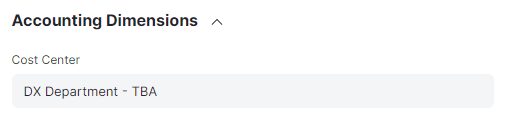

Cost Center: Please enter the cost center for the custodian.

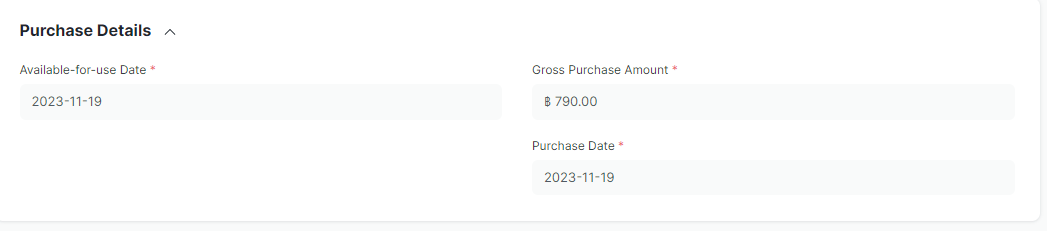

Purchase Details :

- Gross Purchase Amount

- Purchase Date

- Available-for-use Date

Depreciation (Optional)

- Frequency of Depreciation (Months): The number of months between depreciations.

- Total Number of Depreciations: The total number of depreciations during the useful life of the Asset. In case of existing assets which are partially depreciated, mention the number of pending depreciations. For example, if you set frequency as 12 months and no. of depreciations as 3, 1 depreciation will be booked every 12 months for 3 years.

- Depreciation Method: There are four available methods for depreciation: Straight Line, Written Down Value, Double Declining Balance and Manual. You can find more details here.

- Depreciation Posting Date: The date from which booking of depreciation will be started.

- Expected Value After Useful Life: Useful Life is the time period over in which the company expects that the asset will be productive. After that period, either the asset is scrapped or sold. In case it is sold, mention the estimated value here. This value is also known as Salvage Value, Scrap Value, or Residual Value.

- Salvage Value Percentage: If you want the Expected Value After Useful Life to be calculated automatically based on a percent of the Gross Purchase Amount, mention the percent here.

- Rate of Depreciation: This will be calculated based on the amount entered in expected value after useful life.

- Finance Book: The book against which the depreciation entries should be booked. For more details, click here.

- Depreciate based on daily pro-rata: This divides the depreciation amount by the number of days in a calendar period. For example, the depreciation amount in February is less than the depreciation amount for the months that have 31 days.

- Depreciate based on shifts: This lets you define the number of shifts the asset would run in a period in order to depreciate it accordingly. You need to first define the shift names with their shift factors in the Asset Shift Factor doctype (for example: "half": 0.5, "single": 1, "double": 1.5 and "triple": 2) and set a default. Later if you want to change the shifts of an asset for a particular period, you can do so using the Asset Shift Allocation doctype, and the remaining shifts are automatically adjusted.

Depreciation Schedule

On booking depreciations against this Asset, the Depreciation Schedule section will be visible. This table has columns for Finance Book, Schedule Date, Depreciation Amount, Amount Depreciated, and Journal Entry.

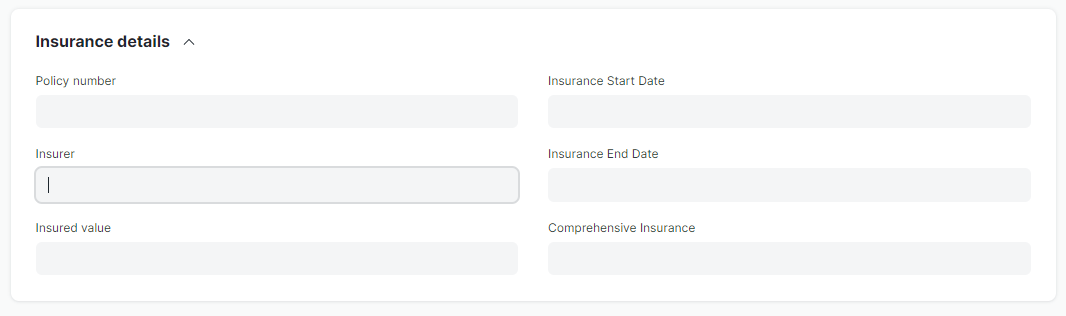

Insurance Details

If Insurance has been taken for the Asset you're recording, you can store the following Insurance details:

- Policy number

- Insurer

- Insured value

- Insurance Start Date

- Insurance End Date

- Comprehensive Insurance

Maintenance

Ticking on Maintenance Required allows recording Asset Maintenance entries for this Asset. To know more, visit the Asset Maintenance page.

After Submitting

Once you create an Asset, you'll see options to transfer, scrap, or sell the asset. From the Make button, you can adjust its value and make a depreciation entry.

More articles on User Guide For HR-Admin